Social Protection for Informal Sector Workers

How can workers in informal sector contribute towards their own social security?

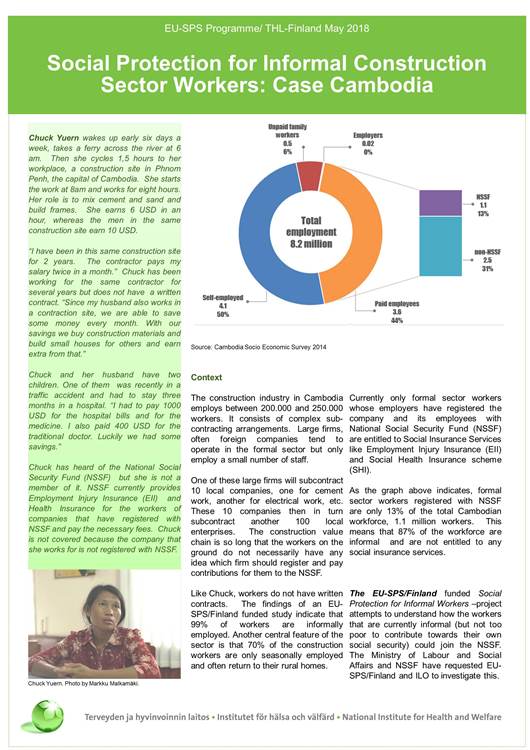

In Cambodia 87% of the workforce are informal and are not entitled to any social insurance services. Currently only formal sector workers whose employers have registered the company and its employees with National Social Security Fund (NSSF) are entitled to Social Insurance Services like Employment Injury Schemes and Health insurance scheme. Formal sector workers registered with NSSF are 13% of the total Cambodian workforce, 1.1 million workers.

How could the workers that are currently informal but not so poor that they can and are willing to contribute towards their own social security be able to join the NSSF?

The existing mechanisms of NSSF have been developed on a “formal employment” model with predictable monthly earnings and a stable and clear employment relationships. However, there is a wide diversity of employment arrangements in the informal economy, such as wage employees, self-employed and casual workers. Thus any expansion of coverage demands new approaches that are tailored to the realities within and across these groups.

The EU-SPS Programme’s work in Cambodia

EU-SPS’s current work in Cambodia is specifically aimed at developing evidence based knowledge and capacity development for the stakeholders on how to integrate the informal works into NSSF. Ministry of labour and Vocational Training and NSSF have requested EU-SPS and ILO for support in extending the benefits of the NSSF to the construction sector, starting with the Employment Injury Insurance.

Construction sector

The project is currently attempting to develop an in-depth understanding of the construction sector, the nature of work, risks within the sector and social protection needs. The construction sector is the fastest growing industry in Cambodia providing lots of jobs, mostly to vulnerable population, often for landless and low skilled workers. The construction sector workers have high risk of accident and injuries.

In the construction sector there are few big foreign contractors that come to invest in Cambodia. These multinational companies they set up small office in Phnom Penh with 5-6 staff. They then subcontract to 10 different local companies, one will be incharge of cement, another for electrical work etc. These 10 companies then in turn subcontract 100 local enterprises that have each 5-6 workers. This means that all this huge industry is below the radar schreen of the NSSF because they all have less than 8 workers.

The construction value chain is long that the workers on the ground do not have any idea who should register them for Social Security and be paying for their benefits. The aim of this assessment is to generate evidence on what is the best and most practical way of expanding the NSSF’s mechanism so that it does not burden companies and does not create negative incentives for companies to try to continue to be informal and not register their workers.

The first step of the assessment is a rapid market assessment on who is working in the sector, what types of subcontracting chains exist, the employment relationship, whether anyone is given written contracts, whether employers are keeping any kinds of contracts of who works for them, how are wages calculated ,how are they paid and whether the workers think can they afford the contributions towards the social security.

Tuk-tuk drivers and domestic workers

However, only half of the informal workforce are in an employment relations with their employers like the workers in the construction sector.

Recently the NSSF has expressed interest to also extend coverage to the self-employed who constitute 50% of all the people employed in Cambodia. In order to better understand the implications of self-employment dynamics for inclusion in the NSSF system. Hence, EU-SPS has initiated another assessment on selected groups of self-employed workers, tuk-tuk drivers and domestic workers who have expressed an interest in participating in the social security system.

There have been discussions to allow associations of self-employed workers to register as quasi enterprises, allowing access to benefits to those who otherwise would not manage. This work is expected to deepen the understanding of the possibilities of having organised groups of self-employed workers contributing to social insurance and promote a government-led approach to deliver social security for informal sector workers.

What benefits does Employment Injury Insurance (EII) offer in Cambodia?

The Employment Injury Insurance (EII) is an insurance provision that covers and protects workers in the event of workplace accidents or occupational diseases. Hence it is very much workplace related benefit and as such is considered as employer liability meaning that the employed is responsible for paying the contributions to the NSSF. Workers do not contribute to this scheme at all.

The benefits of the Employment Injury Insurance (EII) in Cambodia are multiple:

- All medical expenses covered in any public hospital or also in private in an emergency;

- a nursing allowance for a care taker if needed during the time of recovery;

- if temporary disability (e.g. broken arm) the fund covers temporary disability allowance, which is income replacement;

- in the event of death the fund covers funeral allowance for the family;

- permanent disability benefit if worker unable to return to previous employment. The worker will receive a lifetime pension;

- a survivor benefit (in case of death) the dependents allowed to receive a lifetime pension from NSSF (income replacement);

- rehabilitation benefits for workers whose injuries require e.g. fysiotherapy, until they are fit to go to back to work;

The EII is quite generous scheme. However, based on ILO survey in Cambodia results most of formal workers are not aware of these, neither are employers.