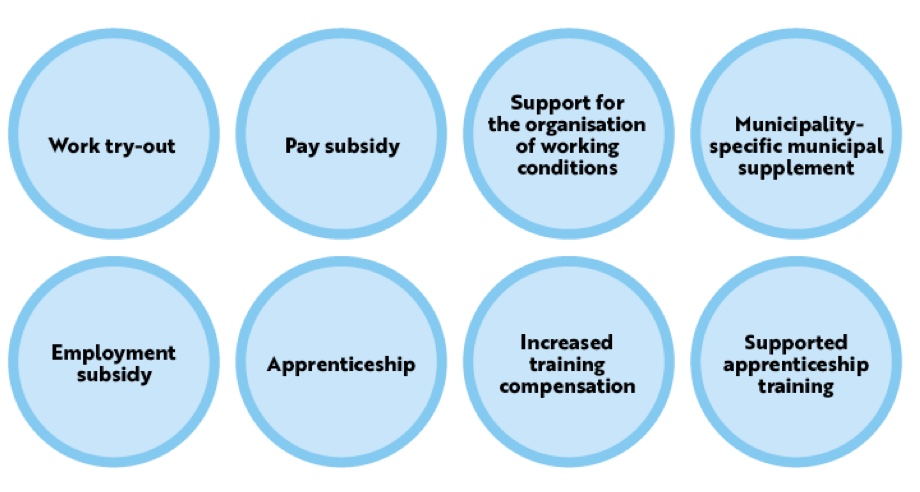

Financial support for employers

Various types of support and assistance are available in Finland for both the jobseeker and the employer in the recruitment of persons with partial work ability. Their aim is to lower the threshold for hiring an employee with partial work ability and to support successful, economically viable recruitment from the perspective of both the employed, the employer and the work community.

You can use various forms of support for recruitment and financial incentives before and after recruiting. The employer should look into these before hiring an employee.

Jobseekers are often aware of their possibilities for receiving subsidies. As the service system is versatile, TE Services job coaches or work ability coordinators are the best way to get started. Subsidies are generally discretionary. Please also note that they are considered income for the employer.

Work try-out. If you want to determine whether a person you have selected is suitable for a specific job, you should start with a work try-out. Work try-outs are arranged by e.g. TE Offices, the Social Insurance Institution and employment pension institutions. A company can also register with the TE Office itself as a party where work try-outs are possible.

As the work try-out is not an employment relationship, no salary is paid for its duration and it does not accumulate annual holidays or pension. A person participating in a work try-out is also not within the scope of occupational health care. Working time can be increased gradually, for example, by one hour every two weeks working up from 4 hours to 8 hours a day. Changes can also be made in the working environment. The maximum duration of a work try-out is 12 months – however, not more than 6 months for the same employer. Most times a 1-3 month contract is sufficient.

A written work try-out agreement will be drawn up between the workplace where the try-out will take place, the work try-out organiser and the person participating in the work try-out. The agreement will contain information on the duration, objectives and tasks of the work try-out. The work try-out organiser will be responsible for taking out insurance for the person participating in the work try-out. If necessary, the support of a work ability coordinator or job coach can be utilised in the learning of job tasks. The TE Office may terminate the work try-out agreement for reasons such as unauthorised absences. A person taking part in a work try-out can terminate the work try-out at any time.

Organising a work trial at a workplace (suomi.fi)

Support for payment of salary

A pay subsidy allows you to hire an unemployed jobseeker who has had difficulty finding employment. A pay subsidy can allow you to continue a work try-out participant’s employment after the work try-out. The condition for this is that the jobseeker has lacking professional competence or a disability or illness affecting their professional coping in job tasks.

The subsidy may also be paid for part-time employment or during apprenticeships. Between 30 to 50 per cent of salary costs can be reimbursed for a period of 6 to 24 months.

It is possible to get more than one pay subsidy period for persons with partial work ability. A pay subsidy is discretionary support that the TE Office can grant within the limits of the appropriations available to it.

Each person with partial work ability has their own TE official

An employment contract is formed in accordance with the normal practices of the workplace. The discontinuation, continuation or termination of pay subsidised employment should be discussed with a TE Office official. The terms of employment are listed on the job description form.

Pay-subsidised employment supports the payment of a salary. Pay-subsidised employment is also arranged via the TE-Office, but the company is responsible for the payment of insurance and entering into a normal employment contract. Each person with partial work ability has their own TE official, to whom the jobseeker can also independently propose the start of a work try-out or pay-subsidised employment.

Pay subsidy to support job seeking (suomi.fi)

Support for procurements

Support for the organisation of working conditions. An employer may be eligible for a subsidy for arranging working conditions if the disability or illness of the person to be employed or if an existing employee requires the procurement of new tools or furnishings or the implementation of changes the workplace. In this case, the maximum amount of the subsidy is EUR 4,000 per employee. The compensation may also be paid for assistance by another employee for a maximum of 20 working hours per month for a period of up to 18 months. The subsidy is EUR 20 per hour and is paid retrospectively each month.

For additional information on new tools and modifications contact your occupational health care or see the following links:

Vates Foundation

Finnish Institute of Occupational Health

Subsidy for arranging working conditions (suomi.fi)

Remuneration for employment

Municipality-specific municipal supplement. Some municipalities (e.g. Helsinki and Vantaa) have a company supplement trial underway. The company supplement is a discretionary, appropriation-based remuneration for companies that employ a person in a difficult labour market position.

An example of this is the Helsinki-benefit, The City of Helsinki will grant the Helsinki-benefit to employers who hire unemployed Helsinki residents for the private sector or volunteer sector. The benefit is always discretionary.

Helsinki-benefit vouchers

Helsinki-benefit vouchers are distributed through the City’s employment services to unemployed Helsinki residents for whom future employers can claim Helsinki-benefit to hire. The voucher is submitted as an appendix to the Helsinki-benefit application.

Helsinki benefit for employersit

Obtain skilled employees through apprenticeship training

You can make use of an apprenticeship when hiring new employees. Employers in the private, public and third sectors are suitable as apprenticeship training places. The work tasks offered must be sufficiently diverse to allow the student to learn during their work and meet the vocational skills requirements for their qualification. An apprenticeship trainee must be offered at least 25 working hours a week.

The employer is paid training compensation for guiding on-the-job learning. The amount of training compensation granted varies depending on the apprenticeship training’s content and the qualification to be completed. The compensation is 0-100 euros a month per students targeting them. You can also apply for pay subsidy for the entire apprenticeship period.

Increased training compensations can be paid to employers for the implementation of apprenticeship training in vocational basic or additional studies for students who have completed their basic education or voluntary additional basic education in the same year. The compensation is intended for the guidance and support of young people. The compensation is EUR 800 per month for the first apprenticeship year, EUR 500 per month for the second year and EUR 300 per month for the third year.

A supported apprenticeship is apprenticeship training combined with the support required by the student, such as job coaching. The need for support may be related to study planning, learning challenges, social skills or life management. The support will proactively ensure that the objectives of the apprenticeship are achieved. A pay subsidy may also be paid for a supported apprenticeship. If you have any questions regarding apprenticeship training, please contact your local apprenticeship office.

Apprenticeship (oppisopimus.fi)

What if an employee with partial work ability becomes completely work disabled?

A large employer insured by the employment pension company (= wages and salaries exceed EUR 2 million/year). The payment category of the earnings-related pension contribution is determined by the employer’s disability risk compared to the average risk. The risk is calculated by comparing the amount of disability pensions previously granted with the average amount of employee pensions.

If an employee with partial work ability becomes completely incapable of work during the first five calendar years, the employee’s disability pension will not affect the company’s payment category. It is important that before employment begins, the jobseeker has notified the TE Office of their illness or injury affecting work ability and submitted a B medical certificate related to this. A TE Office customer may request a certificate from the TE Office to give to a large employer stating that the jobseeker has been entered in the TE Office’s customer register as a jobseeker with partial work ability.

The employee will personally submit the certificate they have received from the TE Office to the employer. The employer will forward the certificate to their insurance company when applying for a disability pension, and the matter will be taken into account in the calculation of the employer’s payment category. A certificate is not required if the employee has been granted a pay subsidy due to illness or disability or if the employee is already on disability pension.

Use the calculator to determine the effects of employment subsidies on the salary expenses for employees with partial work ability

Otetaanko tää pois, kun laskuri vanha ja vain suomeksi?

The employment subsidy calculator has been developed as part of the Easy Steps towards Working Life project for the use of companies. For now it is available only in Finnish. It provides examples of subsidies provided by the state and a few of the municipalities in the Helsinki Metropolitan Area granted for the employment of persons with partial work ability.

The amount of subsidies granted is always individual and case-specific, and the decision is influenced by such factors as the jobseeker’s background, the financial situation of the recruiting company and the appropriations allocated for state and municipal subsidies.

The result of the calculation is not binding for any party and cannot be invoked. The subsidy amounts provided by the calculator are based on data for 2019.